Let’s read this article on the Definition of Monetary Policy- Objectives and Instruments…

Presented by Aakriti Yadav-

Meaning of Monetary Policy-

Monetary policy is a tool used by the central bank of a country to regulate the supply of money and determine the lending and borrowing rates of interest. It is one of the most powerful tools of macroeconomic policy that influences consumption, saving, investment, economic growth, etc. of an economy.

The economist Harry Johnson defines monetary policy as a “policy employing central bank’s control of the supply of money as an instrument of achieving the objectives of general economic policy.”

Objectives of Monetary Policy-

The objectives of monetary policy are generally the objectives of macroeconomic policy, viz. control inflation, determination of interest rates, ensuring price stability, exchange rate stability, and encouraging economic growth, etc. Let us explain these objectives in some detail-

- Determination of Interest Rate and Control of Inflation- The prime objective of the central bank is to determine the repo rate and control inflation within a targeted band. In India, the Chakravarty Committee had recommended an annual inflation of 4 percent which should be socially tolerable, and conducive to economic growth.

- Price Stability- Monetary policy helps in balancing price stability in an economy with the help of money supply. During inflation when prices rise substantially, the central bank will increase interest rates on advances. In this way, central banks suck the excess liquidity from the market and control inflation. Similarly, in the case of deflation, when there is low demand in the market, the central bank also lowers interest rates on loans to infuse the money supply in the economy. Therefore a well-planned monetary policy helps in Price Stability and prevents an economy from collapsing.

- Flow of Institutional Credit– Tools of monetary control affect largely the flow of institutional credit. This increase or decrease the demand for money by the people. The central bank of a country provides credit to commercial banks that channelize it to the people, corporates, and other financial institutions.

- Exchange Rate Stability- In the case of a floating exchange rate demand and supply of goods and services are determined by market forces of an economy which results in disturbances of the exchange rate system and impacts capital inflow and outflow, interest rates, economic growth, investment, etc. In such cases, central banks use a fixed exchange rate system by deciding the exchange rate of local currency to foreign currency and preventing devaluation and revaluation of currencies.

- Economic Growth- Promoting economic growth is another objective of monetary policy. Monetary policy can promote economic growth by ensuring the availability of money supply and loans in the market. By providing cheap loans to industrialists it ensures capital formation, which will help in employment generation, output expansion, increases in income and demand of consumers, etc. Thus easy availability of loans helps in achieving the objective of economic growth of a country.

Instruments of Monetary Policy-

The instruments are the economic variables that help in achieving the objectives of the monetary policy. The central bank adopted the tools of monetary policy to control and regulate the supply of and demand for money and the availability of credit. the instruments are also called ‘weapons of monetary control’. Samuelson and Nordhaus call them “The Nuts and Bolts of Monetary Policy.”

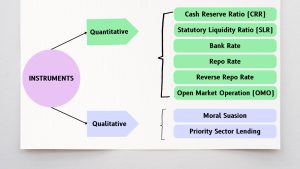

There are two types of instruments or tools of monetary policy for controlling credit in the economy. They are- Quantitative or general credit control tools and Qualitative or selective credit control tools.

-

Quantitative or General Tools-

Quantitative tools also known as indirect tools affect the entire economy of a country. It is the traditional measure of monetary control. It consists of statutory reserve requirements i.e. CRR and SLR, Bank Rate, Repo Rate, Open Market Operations, etc.

- Cash Reserve Ratio (CRR)– CRR is the amount deposited by commercial banks in the vault of the Central Bank. Banks do not receive any interest or profit on CRR.

- Statutory Liquidity Ratio (SLR)– Banks must keep these deposits in liquid assets such as cash, gold, G-Sec, T-Bills, etc. Banks earned some profits in this case.

- Bank Rate- Bank rate is the minimum rate at which the central bank of a country provides loans to the commercial banks of a nation. The bank rate is also called the discount rate because the central bank used to provide finance to commercial banks by rediscounting bills of exchange. Through changes in the Bank rate, the central bank can influence the creation of credit by the commercial banks. Bank rate is also used for deciding penalty rates on banks.

- Repo Rate- Repo rate is the interest rate at which the Central bank lends short-term loans or overnight funds to the banks by keeping their securities as collateral.

- Reverse Repo Rate- It is the interest rate where commercial banks can earn interest by parking their surplus funds to the Central bank.

- Open Market Operations- Open market operations are another tool of monetary policy. The term open market operations mean the purchase and sale of securities by the central bank of a country. The sale of securities by the central bank results in the contraction of credit and the purchase of credit leads to expansion.

-

Qualitative or Selective Credit Control Tools-

Selective credit controls are meant to regulate the flow of credit for particular or specific purposes. It is also known as direct tools. It includes Moral Suasion, Priority sector lending, etc.

- Moral Suasion- It is the method of persuasion by the central bank of a country to ask commercial banks to cut their repo rates, providing loans to priority sectors such as farmers, women, weaker sections, etc.

- Priority Sector Lending-. Priority sector lending ensures the availability of loans to the weaker sections of society, agriculture, micro-enterprises, etc.

Role of Monetary Policy in the Development of a country-

Monetary policy increase production capacity or output, capital stock, and income, promotes savings to households by providing interest on their savings, availability of cheap loans to factories, job creation, GDP growth, etc.

Expansionary and Contractionary Monetary Policy-

An expansionary monetary policy focused on increasing the money supply in an economy by lowering the interest rate thus increasing liquidity in the market. It is also known as the Hawkish monetary policy.

Contractionary Monetary policy-

A contractionary monetary policy is focused on decreasing the money supply in an economy by increasing the interest rates thus reducing market liquidity. It is also known as the Drovish monetary policy.

Conclusion of Definition of Monetary Policy-

Monetary policy plays an important role in the growth and development of a country. It ensures credit availability to businessmen, farmers, and entrepreneurs, encouraging the inflow and outflow of capital in a domestic and foreign countries. Therefore with the help of monetary instruments central bank of a country controlled entire banking system reshapes its economy in case of disequilibrium by targeting its objective of economic policy.

Thank you guys for spending your valuable time on this article on, Definition of Monetary Policy- Objectives and instruments. I hope you gained new information from this article. please share it with friends and let me know your feedback in the comment section.

Cryptocurrency and Blockchain Technology

Unemployment- Types and Causes

Good article.

Excellent please write an article on macro economics unit 4 ,before on October 26

Sure