In this article, we will learn about Fiscal Policy Definition…

Definition-

‘Fiscal’ is a word derived from Greek, means ‘basket’ and symbolizes the public purse.

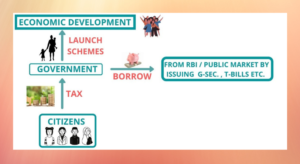

Fiscal policy means the use of taxation, public borrowing, and public expenditure by the government for purposes of ‘stabilization’ or ‘development’.

Objectives of Fiscal Policy-

Fiscal policy is designed as an instrument of promoting economic development aims at achieving the following objectives:

-

To maintain and achieve full employment-

An effective fiscal measure aims to achieve full employment or near full employment. Various rural employment programs, like MGNERGA, have been undertaken by the government of India to solve problems of unemployment and underemployment by using fiscal tools.

-

To control inflation and deflation-

To curb inflation government increases the direct and indirect tax rates so that people have left the low disposable income for their expenditure. This results in less demand for goods and services and ultimately controls inflation. In the same way, to fight with deflation government decreases tax slabs to boost demand. Thus fiscal policy is used as a powerful weapon to combat inflation and deflation like crises.

-

To boost inclusive growth-

The government imposes higher taxes on the rich and diverts that income from richer to poorer sections of the community. Then spend that income on health, education, sanitation, women empowerment, poverty removal schemes, rural employment, financial inclusion, etc. to ensure inclusive growth for all. Thus government channelizes the money from upper to lower strata of the society through fiscal instruments.

-

To boost regionally balanced growth-

The government gives tax exemption to industrialists for setting up factories in the north-east, left-wing extremism, and other aspirational areas. There are various projects initiated by the government like building up dams on rivers, electricity, schools, roads, infrastructure, etc. to mitigate the regional imbalance of the country. This is done with the help of public expenditure.

-

Exchange rate stability-

The central government of the country gives incentives like, the exemption in customs duty, concessions in excise duty while producing things in the domestic markets, it motivates the foreign investors to increase the investment in the domestic country. Thus government benefits to exporters to boost exports by lowering tax rates; while impose higher taxes on imported items to reduce imports. This leads to control exchange rate volatility.

-

To promote savings and investment-

The government provides income tax benefits to household savings in LIC or Mutual Fund etc. So that industries get new capital for investment. This helps in factory expansion, creating job opportunities, and contributes to GDP growth. Thus fiscal tools drive the savings of households into the investment of a company.

Conclusion-

Using fiscal policy, government influences the savings, investment and consumption in an economy, to achieve certain national goals like income redistribution, economic welfare, economic development and inclusive growth.

I hope guys, you learned a new concept in this article on “Fiscal Policy Definition”. Please share it with your friends and let me know how it was.

Unemployment- Types and Causes

Meaning of Inflation- Types and Causes

Cryptocurrency and Blockchain Technology

It was very informative and knowledgeable

It’s really knowledgeable..

thankyou please read more.